Smarter digital SME finance institutions

Lending as a Service (LaaS) is a cloud based, digitally native lending solution for financial institutions to rapidly increase speed to market, generate increased revenue and reduce costs.

LaaS is delivered through a unique, mutually beneficial partnership that enables your business to launch revenue-generating products and reach new customers faster with greater efficiency.

Tailored for your business

We work with you to configure a flexible, automated and fully scalable lending solution that works with your existing systems and is specifically tailored to your business needs.

Our proprietary technology harnesses the power of data to analyse thousands of data points – automating processes to provide a seamless customer experience and deliver deeper insights to empower your team.

Our approach combines high tech with high touch, offering as much or as little support as needed – to digitally transform your business services at a speed that’s right for you.

A digital engine for growth

Beehive as a partner can help you automate your business to improve efficiency, optimise experience, unlock insights and deliver enhanced value to your customers, teams and business as a whole.

SME financing partnerships

Gulf Investment Bank (GIB)

Beehive provides SME financing in Saudi Arabia in partnership with GIB. The partnership is the first of its kind in Saudi Arabia, harnesses Beehive’s proprietary technology and GIB’s banking infrastructure.

The platform provides Working Capital Finance, a flexible short-term solution to quickly improve cashflow for up to four months, or Term Finance for creditworthy MSMEs that wish to expand for a financing period of up to 36 months. Financing starts from SAR100,000 up to SAR3 million, with the platform having facilitated MSMEs in the Kingdom since launch.

- Quick digital onboarding

- Fast access to finance

- Fully Sharia compliant

- Low rates

Emirates Development Bank (EDB)

As an institutional investor, Emirates Development Bank [EDB] has initially assigned AED 30 million funding via the Beehive platform to qualifying businesses. Beehive will facilitate business loans to creditworthy SMEs looking to expand operations or improve working capital.

The funds disbursed through this partnership have the potential to support hundreds of SMEs by bridging the funding gap and offering SMEs greater and easier access to financial sources. The collaboration with EDB will strengthen the SME ecosystem and support the UAE’s goals to build a robust knowledge-based economy.

Ahlibank Oman

The launch of Beehive in Oman, in partnership with ahlibank aims to aid small and medium-sized businesses (SMEs) in availing financial packages ranging between OMR 20,000 and OMR 100,000 and provide benefits such as competitive pricing, streamlined procedures, and simple repayment terms without the need to provide any security or collateral.

Beehive’s digital SME lending platform will allow ahlibank to reach local businesses through the provision of cutting-edge digital lending solutions that are accessible, cost-effective, provide enhanced security, and encourage sustainable financial inclusion.

LaaS for financial institutions

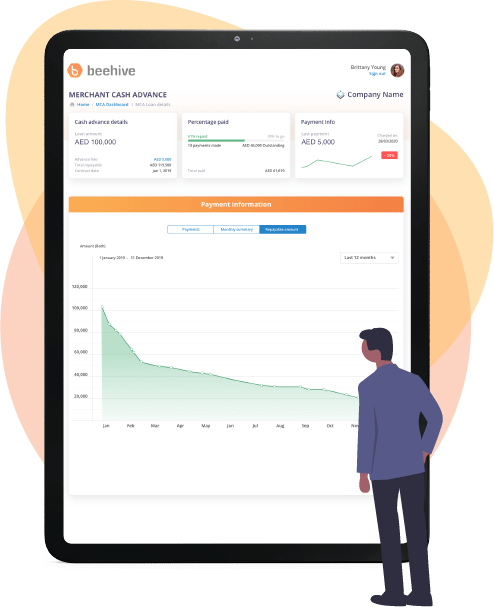

Merchant Cash Advance

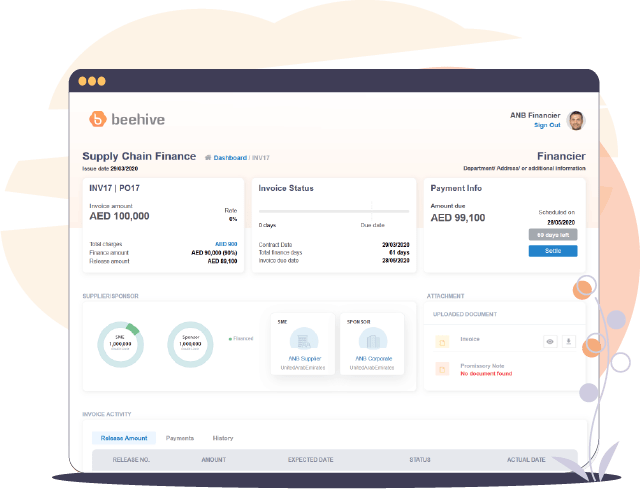

Supply Chain Finance

Beehive provides the technology for a financial institution to offer digitized Supply Chain Finance (SCF). SCF is a product to support an SME’s working capital through the early payment of outstanding invoices. Corporates meanwhile benefit from strengthening and simplifying their supply chain.

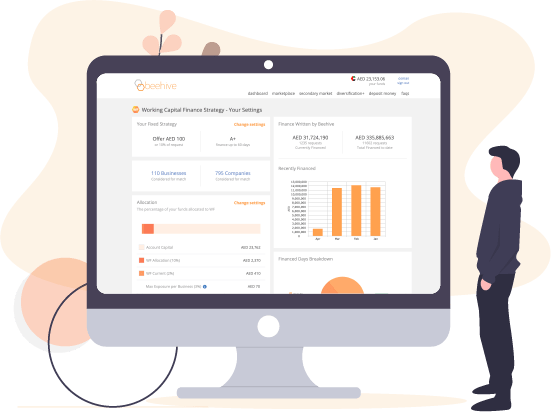

Working Capital Finance

Beehive’s technology enables financial institutions to efficiently offer Working Capital Finance (WCF). SMEs can either receive cash advances against outstanding invoices or receive cash to pay suppliers against current purchase orders.

WCF is therefore a highly flexible, short term financing tool for SMEs and allows a Financial Institution to digitize this process, improve operational efficiency and perform granular lending.

Ready to scale up your digital services?

Connect with Beehive today to see how you can utilise fintech to scale up your product offering.

In the UAE, Beehive P2P Ltd is regulated DFSA

In Oman, Beehive Financial Technology SPC is regulated by FSA

In KSA, Beehive is registered as ‘Beehive Saudi for Technology & Information Systems Company’